The bipartisan debt‐ceiling deal passed in June reflected a new congressional focus on spending restraint. Congress should extend the restraint when it considers a major farm bill this fall. Cutting farm subsidies is a good way to tackle wasteful spending and reduce budget deficits.

Which farm programs should Congress cut?

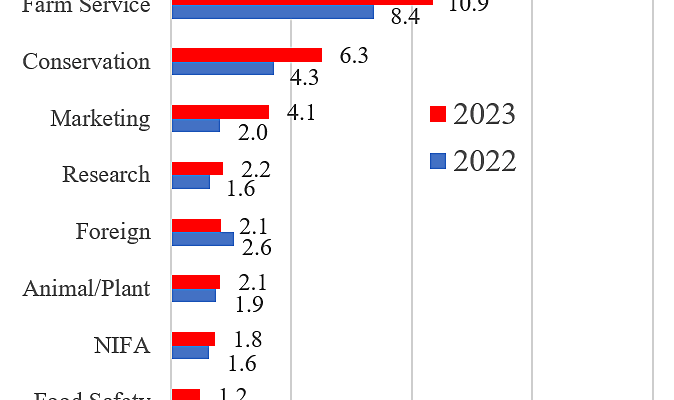

The chart shows U.S. Department of Agriculture (USDA) outlays on farm programs based on fiscal‐year data from President Biden’s budget. Figures for 2023 are estimates. The spending includes direct cash handouts to farmers and indirect support from programs such as agricultural research.

These are the main activities within each budget category.

Crop insurance. Subsidies for crop insurance premiums and insurance company administrative costs.

Farm Service Agency. Subsidies to boost farm incomes when revenues or prices are low.

Conservation. Payments to farmers to improve working lands or to take lands out of production.

Marketing. Marketing programs for farm products and the bizarre Section 32 that spends about $1 billion a year buying selected commodities.

Research. Salaries and benefits of USDA’s agricultural researchers.

Foreign Agricultural Service. Programs to boost farm exports and more than $1 billion a year in food aid to poor countries, which can undermine farmers in those countries.

Animal and Plant Health Inspection Service. Protecting animals and plants from pests and diseases.

National Institute of Food and Agriculture (NIFA). Extension activities and grants to outside researchers.

Food Safety and Inspection Service. Ensuring the safe production of meat and eggs.

Other. Support activities such as statistical analyses.

Total spending on these farm activities was $35 billion in 2022 and $48 billion in 2023. The other main items in USDA’s budget are food stamps, school lunches, WIC, rural subsidies, the Forest Service, and some disaster spending.

Some USDA farm spending is aimed at the broad public interest, such as food safety and animal and plant inspections. Research and some conservation activities may also create broad public benefits.

However, most USDA farm spending simply aims to boost the incomes of farmers and landowners, particularly those with large corn, soybean, wheat, rice, and cotton operations. This spending is misguided, and it should be cut to save more than $20 billion a year.

Crop insurance is a high priority cut, as discussed here. Another reform would be imposing much tighter income caps on all farm subsidies, thus ending welfare for the well‐to‐do. Other cut ideas are proposed by AEI, Heritage, TCS, and EWG.

Some members of Congress support cuts to the USDA’s food stamp program but defend farm subsidies, while others criticize corporate welfare but support aid to large farm businesses. Such hypocrisy needs to end if we are to get budget deficits under control. The food stamp program is vastly bloated and does not support healthy diets, while farm subsidies enrich high earners for no good reason.

How about a bipartisan compromise? Let’s cut both farm subsidies and food stamps in this year’s farm bill.