Here is the abstract from the paper which is forthcoming in the Journal of Economic Education:

Economic theories of the exploitation of depletable natural resources are built around a core model of intertemporal profit maximization that predicts that (barring unforeseen shocks) scarcity crises will not arise because forward looking resource owners will smooth extraction over time. The model that provides this result can seem opaque to students, but its intuition can be more easily grasped from experience. This paper shares a game that provides that experience. Participants play the role of mine owners who must decide how much to extract in each of two periods. In addition to showing how market pressures moderate intertemporal scarcity, the game also provides lessons about discounting, market power, information, and property rights. I provide all materials needed to play the game immediately or customize it.

I customized the game for my class and focused on three scenarios:

Monopoly with no discounting

Monopoly with a 25% discount rate in the second time period

Competition with a 25% discount rate in the second time period

Here are the instructions I used: Ore money ore problems slides.

I had 12 out of 17 students in class (not bad for the class day after exam #2 on a beautiful afternoon) and we formed 6 miner teams of 2 students each. I passed out the record sheet, read the instructions and used Poll Everywhere to receive the period 1 extractions for each of the 6 mines (I displayed the decisions on the screen but next time I’ll use my phone so decisions will be secret while students are still mining).

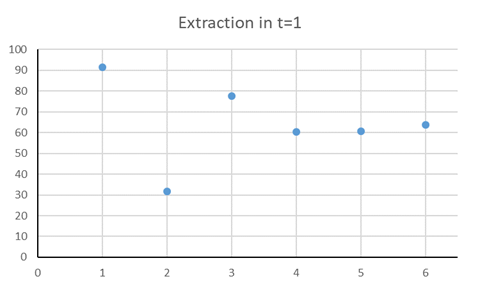

Here are the results (the dots are the average resource extractions over 6 rounds of the game):

The first two rounds (horizontal axis) were the no discounting rounds and the theoretical prediction is extraction in time period 1 is 50 units (vertical axis) as this equates prices across the 2 time periods. Five mines produced 100 units depleting the resource for t=2 and 1 mine extracted 50 units. These numbers were entered into the spreadsheet for all to see and everyone realized 100 is too high. We discussed this result and ran the scenario again with students overshooting with extraction rates of 0, 25, 30, 35, 50 and 50. Instead of averages, you can look at the answers and say that the number of mines producing the profit maximizing amount doubled from 1 to 2. I’m sure if we ran scenario 1 one more time we would have been close to the theoretical prediction.

In scenarios 2 and 3 I introduced a discount rate of 25% so that future profits are 80% of current profits. Students again went in the right direction with their extraction decisions but overshot the target of 53 with 75, 75, 75, 75, 75 and 90 units extracted in the first round. The spreadsheet showed that profits with 75 units are higher than with 90 units and in the fourth scenario the extraction decisions were 50, 55, 60, 63, 65 and 69 units. I’m sure that another round of scenario 2 would have produced an average close to 53.

In the fifth round (scenario 3) the units extracted were 48, 51, 53, 53, 60, and 100. Two of the mines produced the cooperative outcome of 53. We discussed the OPEC cartel problem and in the next round production went up slightly. I’m sure that more rounds with this scenario would lead to increased extraction in t=1 as predicted by theory.

The game took 45 minutes after about 30 minutes of debriefing exam #2. We’ll debrief the game more tomorrow and work our way through the two-period model and Hotelling’s Rule. Participation in this game is going to help.

Bottom line: The game worked great in terms of getting the point across, not so great in terms of generating theoretically predicted results but more rounds with each scenario would get us there. Next time I’ll probably drop the competition scenarios and spend more time on using the equimarginal principle to maximize profits over time.

Comments welcome!